Starting at Just Rs. 699/- (All Inclusive)

TAN Surrender

- it’s super simple

- completely online

- hand-holding support

- instant response & consultation

it's pocket friendly

it's hassle free

it's instant

it's completely online

Explore various pricing plans

All Inclusive Transparent Pricing #NoHiddenCharges

ITR-1 @ Rs. 699/-

- Salary Income

- Rent Income From One Property

- Interest Income etc.

This pricing plan includes free consultation

Fill inquiry form below to pay later

ITR-2 @ Rs. 1099/-

- Salary Income

- Rent Income From Properties

- Capital Gains or Losses

This pricing plan includes free consultation

Fill inquiry form below to pay later

ITR-3 @ Rs. 1999/-

- All Income Covered in ITR-2

- Income From Business or Profession

- Interest Income etc.

- Income or Loss From Intraday Share Trading

- Income or Loss From Derivatives (F&O)

- Director/Patner in a Company/LLP

This pricing plan includes free consultation

Fill inquiry form below to pay later

ITR-4 @ Rs. 1499/-

- Salary Income

- Rent Income From Propeties

- Professional Receipts up to Rs. 50 Lacs

- Businesses Covered under Presumptive Taxation

This pricing plan includes free consultation

Fill inquiry form below to pay later

Client's Voice is Essential!

h1 {

font-family: Montserrat, sans-serif;

color: black;

text-align: left;

}span {

color: #1cbbfb;

}@media only screen and (max-width: 600px) {

h1 {

font-size: 20px;

}

}Know More

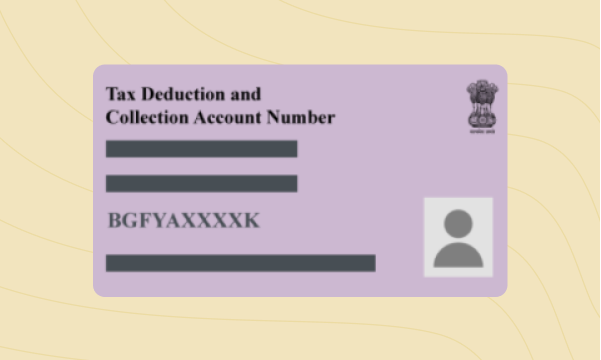

TAN Surrender

An Overview

Hello there! Did you know that if you no longer require the Tax Deduction and Collection Account Number (TAN) issued by the Indian Income Tax Department, you can actually choose to surrender it voluntarily? TAN is a unique ten-digit alphanumeric number that is allotted to entities responsible for deducting or collecting tax at source. So, if any entity or organization wants to surrender their TAN due to closure of business operations or changes in tax obligations, the surrender process is quite simple. All you need to do is submit an application to the relevant tax authorities along with the necessary supporting documents and fulfill any additional requirements specified by the tax department. Don’t worry, we are here to assist you throughout the process.

Is It Mandatory?

Yes, surrendering the Tax Deduction and Collection Account Number (TAN) is mandatory if you no longer require it or if you cease to be liable for deducting or collecting tax at source. When an entity is no longer engaged in activities that require TAN, it is advisable to surrender the TAN to the Income Tax Department. By surrendering the TAN, you inform the tax authorities that you are no longer eligible or obligated to deduct or collect tax at source. This helps maintain accurate records and ensures compliance with tax regulations.

Information / Documents Required

General Documents / Informations Required from all assessees:

Surrender Application: Prepare a surrender application on your organization’s letterhead. Include details such as the TAN number, name of the deductor/collector, address, and reasons for surrendering the TAN. Sign and date the application.

Original TAN Certificate: Attach the original TAN certificate issued to you along with the surrender application. It is important to return the original TAN certificate to the tax authorities.

Identity Proof: Provide a copy of your identity proof, such as a PAN card, Aadhaar card, voter ID card, passport, or driver’s license. This helps in verifying your identity.

Address Proof: Include a copy of address proof, such as a utility bill (electricity bill, telephone bill, etc.), bank statement, ration card, or any other document issued by a government authority containing your address. This is required to verify your address.

Surrender Intimation: Include a copy of the intimation letter or communication sent to the relevant tax authorities informing them of your intention to surrender the TAN.

Due Date

The message is already well-written and only has a few minor issues with capitalization and punctuation:

“The surrender of a Tax Deduction and Collection Account Number (TAN) in India does not have a specific due date. However, it is recommended to surrender the TAN as soon as it is no longer required or when you cease to be liable for deducting or collecting tax at source. Once you have determined that you no longer need the TAN, it is advisable to initiate the surrender process promptly. This helps ensure compliance with tax regulations and helps the tax authorities maintain accurate records.”

Benefits

Surrendering the TAN ensures compliance with tax regulations. When you no longer have the obligation to deduct or collect tax at source, surrendering the TAN helps you avoid any potential non-compliance issues.

Surrendering the TAN helps maintain accurate records with the tax authorities. It ensures that the tax authorities are aware that you are no longer engaged in activities that require the TAN, preventing any confusion or mismatch in records.

Surrendering the TAN simplifies administrative processes. Once the TAN is surrendered, you no longer need to file TDS/TCS returns or comply with related reporting requirements, which can reduce administrative burdens.

Surrendering the TAN can lead to cost savings. You no longer need to pay fees associated with TAN-related compliance, such as filing TDS/TCS returns or maintaining TAN-related documentation.

Surrendering the TAN in a timely manner helps you avoid penalties or legal consequences for non-compliance. It demonstrates your commitment to fulfilling your tax obligations and helps maintain a positive relationship with the tax authorities.

Surrendering the TAN provides clarity in your tax position. It clearly indicates to the tax authorities that you are no longer liable for tax deductions or collections at source, helping them assess and manage their tax administration more efficiently.